Reviewing OBIO's Primary Market Research Workshop

Last week, OBIO hosted a workshop with Gary Svoboda (CEO, Adventus Research + Consulting) who provided the audience practical steps to validate technology using primary market research.

Primary market research allows for better business and better product development decisions. It can help you determine whether potential users see your technology as significantly better than current solutions, what benefits (quicker, better, safer, cheaper) they think are most valuable, and how different that benefit needs to be for them to use it. This information can be used to prepare your target product specifications right at the start of product development. Consequently, primary market research should be performed early and often.

Every market assessment should start with secondary market research to develop or validate your knowledge of market size, trends, segmentation and competitive environment (check out several OBIO workshops on secondary market research on the OBIO Members portal). This is then followed by the primary market research which provides specific information on your technology or concept.

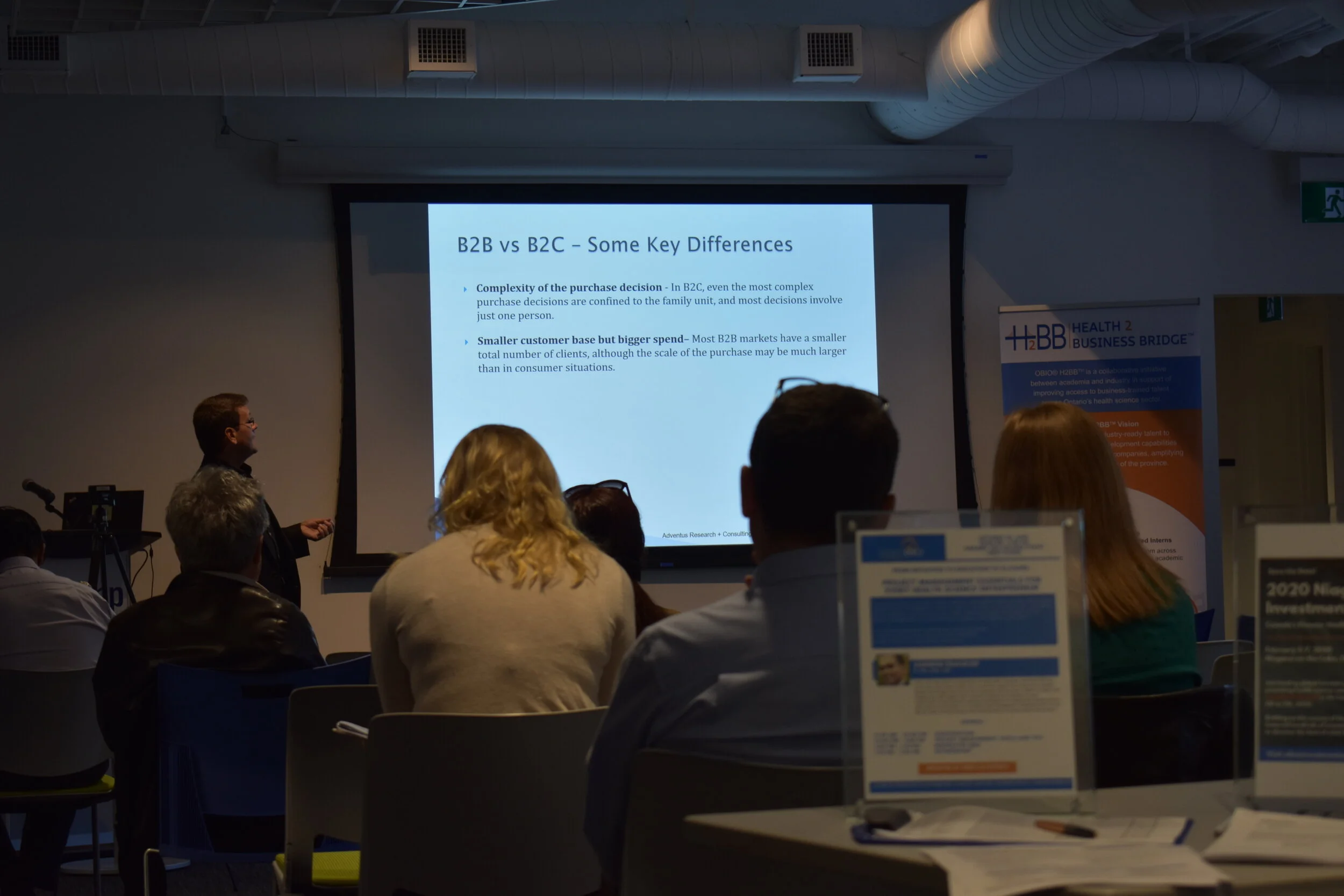

Gary’s presentation included a discussion on the pros and cons of the various methods of market research (in person interview, telephone interview & surveys, web surveys and panels) and the differences when dealing with B2B vs B2C technologies. Gary typically uses telephone interviews of 15 to 25 stakeholders when conducting a market assessment for a new B2B technology.

Gary shared how he uses an interview guide which comprises three sections an introductory letter, a description of the technology and its value proposition and then a list of 10-12 questions, which should take not more than 10 to 20 minutes to go through. Questions that should be included in every interview guide include:

“How satisfied are you with the existing solutions in this technology/business area? (scale of 0-10) and explain why you gave this rating?”

“What do you think of the technology/product concept? (scale 0-10) and explain why you gave this rating?”

These questions allow you see the difference in the satisfaction between the current solution and your proposed solution and evaluate whether the difference is big enough to justify moving ahead or if you need to pivot.

“How important are the proposed advantages that we presented in the technology/product description?”

Asking this question allows you the opportunity to identify the most important product advantages – the ones that really count. Gary noted this this works best if you can ask interviewees to select between 4-6 proposed advantages.

“What value would you place on the proposed product?”

Try and use metrics that the market stakeholder will be most familiar with (it might not be $ - specifiers (users) and purchasers may NOT be the same group). Instead, think about other value metrics like: speed, lifespan, customer complaints/return rate, cost of warranties, cost of related capital equipment, etc.

To find out why Gary scales from zero to ten (not one to ten), to hear how to find and secure the stakeholders to interview, and to download an example interview guide as well as to access a recording of the whole presentations, visit the OBIO Members portal.