Reviewing 'In-Licensing from Tech Transfer Offices: Terms, Tips & Impact on Investability'

On August 21st, OBIO hosted Norton Rose Fulbright’s Anthony de Fazekas (Partner, Head of Technology & Innovation) and Vanessa Grant (Partner), Lumira Ventures’ Jacki Jenuth (Partner), and University of Toronto’s Karen Temple (Commercialization Manager) who discussed practical considerations for licensing health science technologies from tech transfer offices, and how these agreements can impact a company’s future investability.

Anthony kicked off the workshop by stressing the importance of developing a plan for managing your company’s intellectual property (IP) strategy. There can be a tendency to focus on patents, but entrepreneurs should consider a broader IP strategy, including trade secrets, team expertise & know-how, transfer of knowledge, data ownership, and access to data, all of which add value to a company’s IP assets. Entrepreneurs should use their IP strategy as a toolkit to protect value in their enterprise and their people, where a company’s know-how lies in their talent. When in-licensing technologies from a tech transfer office, the license is only one component of the company’s IP strategy, but like the entire strategy, it needs to be reviewed and updated over time to align with the company’s business strategy.

Next, Anthony explained that Chain of Title is critical for financing and is likely the most common issue that arises for early stage companies, as it deals with who owns the assets and the various policies that impact ownership. It is rare and unlikely to secure 100% complete chain of title, as there are usually multiple teams and institutions involved. However, it is critical for entrepreneurs to review this carefully, address any gaps at an early stage, and continue managing Chain of Title as the company moves forward.

Before diving into negotiating a licensing agreement, Vanessa recommended that every entrepreneur take a step back and put together complete financing, business & IP strategies. The importance of linking these strategies was also reiterated by the other panelists throughout the workshop. In negotiating a license, entrepreneurs should consider restrictions (e.g. time, data exclusivity, territory) and financial terms (e.g. equity, royalties, milestone payments, sublicensing revenues). For example, in considering territories, companies should have a strong grasp of where their target markets are. In considering financial terms, companies should think about their exit strategy and managing cash flows now and in the future. For example, high royalty rates may be unattractive to big pharma as it would reduce their profits, but royalties can be helpful to an early stage company that is managing cash flow because payment is delayed until commercialization. Bottom line, you need to crunch the numbers!

This led into Jacki’s presentation, which emphasized that knowing your target addressable market (TAM) is critical to negotiating a license. As a VC, Jacki has seen many entrepreneurs exaggerate market size in an attempt to appeal to investors, but investors prefer companies to segment and show accurate representation of the market. Jacki walked the audience through a market sizing and valuation example for a stroke therapeutic. She recommended taking your time to do the market research and getting the calculation right, it will be worthwhile in the end.

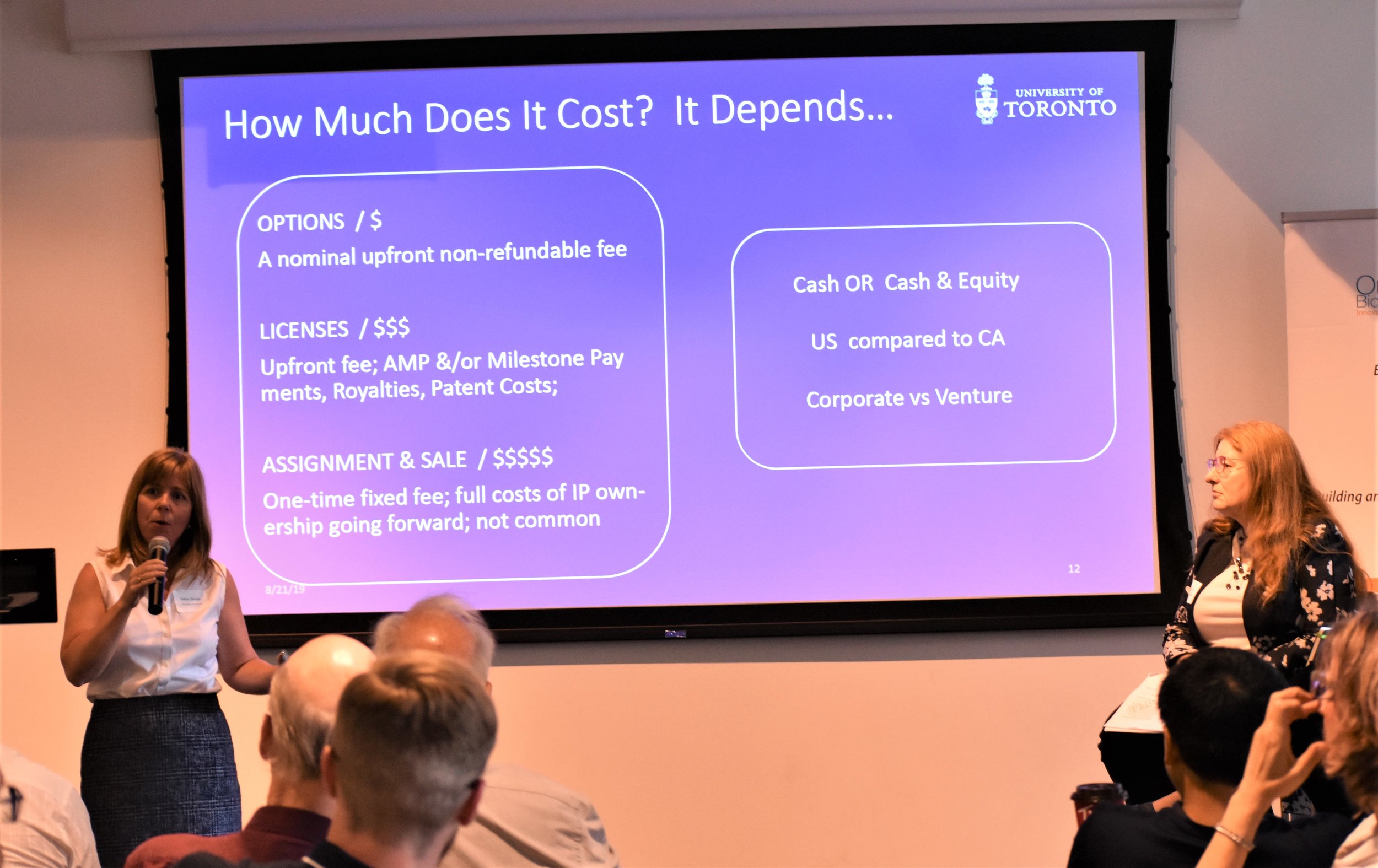

Next, Karen provided an overview of University of Toronto’s IP policy. As a public university, it is important for U of T to see technologies bear social and economic benefits. In assessing ventures, U of T looks for strong teams with a clear business plan for bringing a technology to market. Karen reviewed options, licenses, and assignments/sales. She emphasized that universities are your partner in a negotiation and this relationship should be nurtured, as a license is a relationship contract.

To conclude the workshop, the speakers walked the audience through a sample licensing agreement from Harvard University and took questions from the audience. They provided advice on negotiation strategies, royalties, clauses, the path to ownership, and how changes in business strategy affect a license.

If you missed this valuable OBIO workshop, the recorded webinar of the presentation is now available on the OBIO Member Portal.

If you are not yet an OBIO Member, please click here to become a Member today.